Furthermore he said Kemas plays an essential role in helping the country develop its human capital especially in rural areas. Disposal of Real Properties Shares and Cryptocurrencies Direct Tax.

Small Firms Exporting How Effective Are Government Export Assistance Programs Semantic Scholar

Crowe is the fifth largest accounting firm in Malaysia providing audit tax corporate advisory risk consulting growth consulting and wealth management.

. What Are Capital Allowances in Malaysia. One of these deductions is the capital allowances in Malaysia. The profit arises from the sale of the capital asset is taxed under the head of Income from Capital Gain.

Capital allowances specifically are capital purchases like the acquisition of land and building that can be claimed as tax. Effective Appeals Reinvestment Allowance Cybersecurity Threats Capital vs Revenue. Capital allowances consist of an initial allowance IA and annual allowance AA.

72018 Date Of Publication. Capital allowance tax depreciation on industrial buildings plant and machinery is available at prescribed rates for all types of businesses. Any party cannot deny the contributions and services of Kemas.

Capital gain refers to any gain or profit that is earned by the individual from the sale of a capital asset. The profit is earned by selling the capital asset at. 200 automation capital allowance on first MYR 2 million QCE for years of assessment 2015 to 2023.

In fact its role will continue to be strengthened by focusing on quality early childhood education that can produce a great generation he said. INLAND REVENUE BOARD OF MALAYSIA REINVESTMENT ALLOWANCE PART 1 MANUFACTURING ACTIVITY Public Ruling No. Near frontlines in the south.

102020 Date Of Publication. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Digital Business is a term used to refer to an economy activity based on the use of digital technology.

An Ibadan chief Oloye Taofeek Adegboyega Adegoke has advised Governor Seyi Makinde of Oyo State to without wasting more time involve tra. Any party cannot deny the contributions and services of Kemas. Level 4 Lot 6 Jalan 5121746050 Petaling Jaya SelangorMalaysia Tel.

Initial allowance IA is fixed at the rate of 20 based on the original cost of the asset at the time when the capital was obtained. Capital allowances consist of an initial allowance and annual allowance. Any transactions conducted through digital technology including the providing of information promotion and advertising marketing supply delivery of goods services even though payment and delivery relating to such transaction may be conducted offline.

Minimum Period of Operation 2 6. There is an allowance Freistellungsauftrag on capital gains income in Germany of 801 per person per year of which you do not have to be taxed if appropriate forms are completed. Initial allowance is granted in the year the expenditure is incurred and the asset is in use for the purpose of the business.

There is no capital gains tax for equities in Malaysia. Eligibility to Claim Reinvestment Allowance 1 5. - cost of assets used in a business such as plant and machinery office equipment furniture and fittings motor vehicles etc.

06 November 2020 CONTENTS Page 1. While annual allowance is a flat rate given every year based on the original cost of the asset. 35 Qualifying expenditure means capital expenditure incurred on the provision construction or purchase of plant and machinery used for the purpose of a business other than assets that have an expected life span of less than two 2 years.

122014 Date Of Publication. The different Sections of the Income Tax Act help the salaried individuals and the self-employed people and professionals to make their rent expenditures cheaper and more desirable. 8 Oktober 2018 INLAND REVENUE BOARD OF MALAYSIA _____ Page 2 of 19 43 The conditions that must be fulfilled by a person to qualify for an initial allowance IA and an annual allowance AA are the same as the conditions to claim capital allowances at the normal rate under Schedule.

KYIV Aug 23 Ukraines capital Kyiv banned public celebrations this week commemorating independence from Soviet rule citing a heightened threat of Russian attack in a war the United Nations said yesterday has killed nearly 5600 civilians including many children. C notional allowance which is equal to the annual allowance if claimed or should have been claimed. Tax Leader PwC Malaysia 60 3 2173 1469.

The First Year Allowance is applicable to new vehicles and cars considered new despite previously being used such as vehicles registered as a sales or service demonstrator by the manufacturer. 603-7785 2624 603-7785 2625. As in any regular taxation individuals and businesses can claim allowable deductions from their taxable income.

Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. HRA or House Rent allowance also provides for tax exemptions. Relevant Provisions of the Law 1 3.

200 automation capital allowance on first MYR 4 million QCE for years of assessment 2015 to 2023. The company claimed capital allowances in respect of the mannequins used in the business. Reinvestment Allowance RA Companies based in Malaysia that have been operating for 36 months and above and have spent on QCE of the factory plant and machinery based in Malaysia for reasons to expand modernize and automate their units or in the agricultural industry is eligible for this allowance.

Salaries of the employees of both private and public sector organizations are composed of a number of. YA 2021 plant is defined to mean an apparatus used by a person for carrying on his business but does not include a building an intangible asset or any asset used and functions. Pada penerbangan perdananya Indonesia AirAsia melalui tagline Terbang Lagi Indonesia bersama Capital A sebagai induk usaha grup juga memperkuat komitmennya terhadap pengembangan pariwisata dan pemberdayaan masyarakat di kawasan destinasi wisata Danau Toba melalui penandatanganan Nota Kesepahaman bersama Badan Pelaksana Otorita Danau.

In the March 2020 UK Budget the Government announced that 100 FYA for businesses purchasing low emission cars will be extended until 31 March 2025. Malaysia used to have a capital gains tax on real estate but the tax was repealed in. For high labour-intensive industries rubber products plastics wood furniture and textiles industries.

INLAND REVENUE BOARD OF MALAYSIA QUALIFYING CLAIMING CAPITAL ALLOWANCES Public Ruling No. Furthermore he said Kemas plays an essential role in helping the country develop its human capital especially in rural areas. Qualifying expenditure QE QE includes.

Find out the baggage policy for Qatar Airways including your carry-on and checked allowance plus excess baggage fees. 31 December 2014 Page 5 of 12 Example 3 Cinta Sdn Bhd has several clothing and fashion accessories boutiques in a shopping complex.

Comparison Of Zakat And Taxation

Elevate And Automate Your Operations With Mida Mida Malaysian Investment Development Authority

ليما حمالة صدر مؤقت الدنمارك تشجيع مسطرة Capital Allowances On Vans 2018 19 Moonlightconventioncentre Com

3 Test 1 Q Tax667 Mac2019 Question 1 Mr Elvis A Non Resident Died In Malaysia On 30 April Studocu

Module 4 Upstream Petroleum Economics 1 Introducing Upstream Petroleum Economic Module Seeing The Forest And The Trees Your Learning Partner Background Ppt Download

Preparing The Capital Allowance Computation Acca Taxation Tx Uk Youtube

Task 5 Ex Capital Allowances Pat3033 Taxation Individual Assignment 5 Capital Allowances Amp Studocu

Business Recovery Corporate Insolvency Procedures Company Tax Issues David Payne Ppt Download

What Is Capital Allowance Malaysia Jaredctz

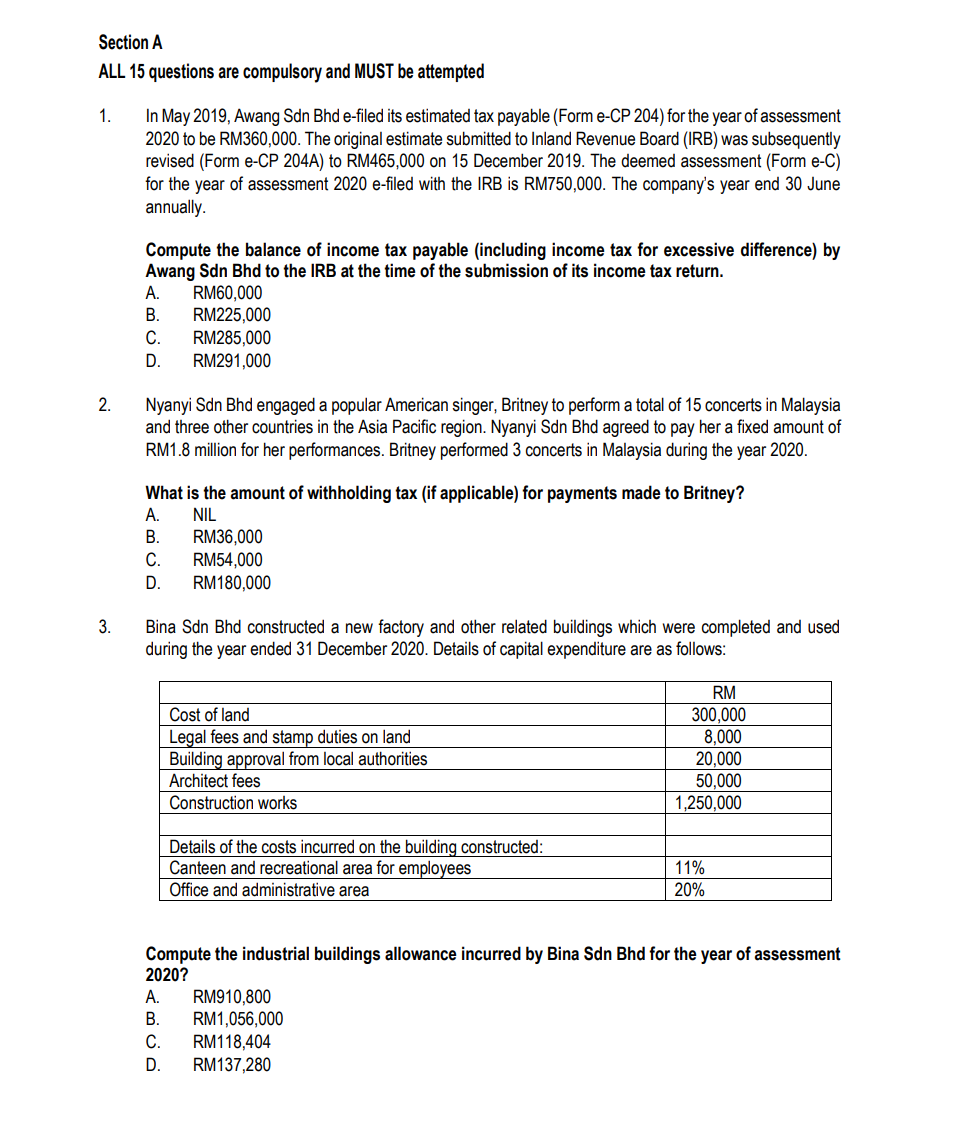

Sample Practice Exam December 2018 Answers Business Income Computation Of Income Tax Payable For Studocu

Small Firms Exporting How Effective Are Government Export Assistance Programs Semantic Scholar

Section B All Six Questions Are Compulsory And Must Chegg Com

Salary Formula Calculate Salary Calculator Excel Template

Chapter 5 Tutorial Taxation Chapter 5 Corporate Taxation Exercise 5 Corporate Tax Quick Notes Studocu